Malaysia Auto Insurance

If you reside in Malaysia and own a car, auto insurance is what you should have. There are different types of car insurance in Malaysia. They are in three categories: comprehensive, third-party, and third-party Fire and Theft coverage. Car insurance is a contract between an auto insurance company and a car owner. In this contract, the company protects the car against damage, theft, loss, or bodily injuries. In exchange for this protection, a car owner pays a premium annually to the insurance company. Car insurance is compulsory in Malaysia according to the Road Transport Act of 1987. However, there are some important factors to consider before choosing the best car insurance in Malaysia.

Benefits Of Auto Insurance

There are different categories of car insurance, and they offer varying benefits. The auto insurance quote or plan you choose determines what you stand to gain. You can purchase car insurance for your truck, commercial bus, motorcycles, and private cars. The general benefits of auto insurance include;

- Coverage for accidents and bodily injury to vehicles

- Coverage from theft of vehicle or damage of another party’s vehicle

- Protection from liabilities arising from injury or death

While many people often search for cheap auto insurance packages, quality is more important. There is a list of car insurance companies that offer quality auto insurance services in Malaysia and affordable. However, auto insurance quote comparison is essential before you choose a car insurance package. Different policies have different quotes and extra benefits. For instance, some policies offer waivers in addition to the essential protection they offer car owners.

What To Know About Car Insurance Malaysia

Before you decide to migrate to Malaysia or obtain a permanent residency, you must know what the law says about auto insurance. First, car insurance is not optional in Malaysia. You don’t get to choose whether you need it. It is mandatory if you plan to drive in any part of the country. Without valid insurance, renewing road tax is impossible in the country. And non-renewal of road tax has implications. A driver who uses a car without an insurance policy in Malaysia can pay up to RM3,000 as a fine. These are all contained in Malaysia’s Road Transport Act (1987). Secondly, some people nurture the thought of purchasing car insurance and not renewing once it expires. This act is illegal; you are breaking the Road Transport Act. If you do not renew your insurance and a fine of RM1,000 is applicable. An individual can also end up spending three years behind bars for this offense.

Choosing The Best Car Insurance Malaysia

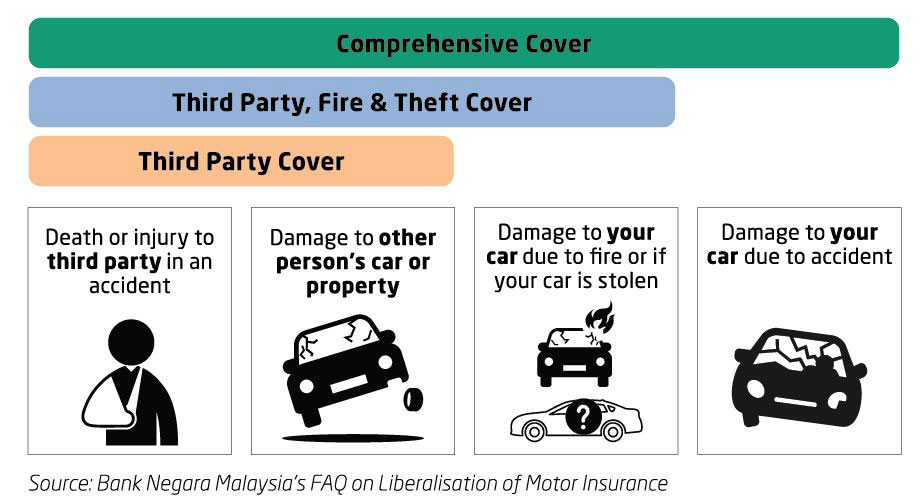

Typically, there are three types of car insurance policies in Malaysia. These are the third party car insurance; third party, fire, theft; and comprehensive policy. These categories of insurance offer different coverages at different premiums. A premium is an amount you pay in exchange for the protection that an insurance company offers. Go through the list of car insurance companies in Malaysia before deciding which to pick. Most car owners buy insurance policies through insurance agents. These are third parties that offer guidance on the selection of policy. Another common way to buy an auto insurance policy is by buying online.

How do I renew my insurance using this service?

Renewing your insurance using fincrew.my is very easy.

- Fill up the form above and click "Get Free Quotation".

- You will receive quotes from each of our insurer, if available for your car. You can sort by price. Pay attention to the different sum insured.

- After you select a quote, you will be taken to the add-ons page.

- Here, you can edit the sum insured, and add on add-ons such as road tax, windscreen coverage, special perils (flood), e-hailing and additional drivers.

- Your NCD is also automatically calculated on this page.

- After you're satisfied with your quote, you can click Continue.

- Fill in your details on this page. You can also key in a promo code here if you have one. Click Continue.

- After you've double checked everything, just click Pay now and pay.

- Congratulations, you're done! You're covered instantly and a cover note has been generated for you.