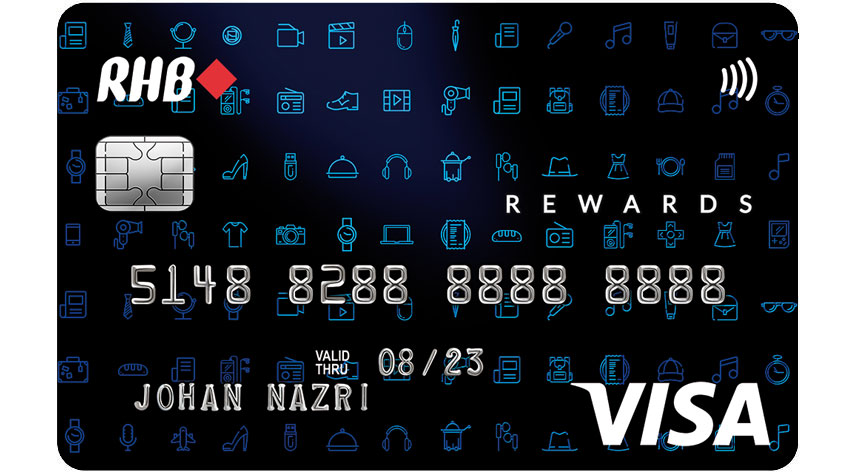

RHB REWARDS CREDIT CARD rewards you with great rewards on your daily essentials spend. Get up to 10x Reward Points when you spend on movie tickets, overseas spend, online & e-wallet, health & insurance, retail shopping and other categories.

ApplyN/A

Free*

N/A

N/A

N/A

N/A

N/A

| Spend Categories | Credit Card Reward Points Multiplier for every RM 1 spend |

|---|---|

| Overseas Spend* | 4X* |

| Online Spend^ | 3X^ |

| Health Spend | 2X |

| Insurance Spend | 2X |

| Shopping Spend | 2X |

| Cinema Entertainment Spend** | 10X** |

| Others Spend | 1X |

Note:

* Overseas Spend is meant for foreign currency transactions performed physically out of Malaysia. Not inclusive of Online, E-commerce, Mail Order Telephone Order (MOTO) and Recurring Auto Debit transactions.

^ Online Spend is meant for all Online, e-Commerce and MOTO transactions in local or foreign currency.

** Cinema Entertainment Spend is meant for any mode of transaction under MCC-7832.

For the list of Merchant Category Code (MCC) which are eligible for Reward Points, please click here

| GOLF CLUBS | BOOKING CONTACT NO. / DETAILS |

|---|---|

| Sungai Long Golf & Country Club Selangor, Malaysia |

RHB Customer Care Centre |

| Kota Permai Golf & Country Club, Selangor Malaysia Club Selangor, Malaysia |

| - | Your purchase is covered from losses due to non-delivery or incomplete delivery of the goods. This benefit also covers you in case the goods you purchased online arrives with physical damage |

| - | Automatically activated when an item is purchased using an eligible Visa card. |

| - | Eligible for online purchases made from any merchants globally |

| - | Claims and insurance details can be made available online from AIG Cardholder Insurance Portal |

| - | Please click here for Terms & Conditions , Claim Forms and FAQs |

| Annual Fee For Primary Card | First year: No Annual Fees - Subsequent years: RHB Rewards Credit Card: RM200 per annum. (will be waived if cardholder spends RM10,000 in a year) RHB Rewards Motion CodeTM Credit Card: RM200 per annum. (will be waived if cardholder spends RM20,000 in a ye |

| Annual Fee For Supplementary Card | waived |

| Minimum Monthly Payment | 50 |

| Late Payment Fee | Maximum of 1% of the outstanding balance or a minimum of RM10, whichever is higher, subject to a maximum of RM100.00 |

| Cash Withdrawal Fee | 5% of the transaction amount or a minimum of RM15.00, whichever is higher, will be charged on all cash withdrawals and licensed betting transactions. Any applicable taxes imposed from time to time are applicable for these charges |

| Interest Rate On Cash Withdrawals | 5% of the transaction amount or a minimum of RM15.00, whichever is higher, will be charged on all cash withdrawals and licensed betting transactions. Any applicable taxes imposed from time to time are applicable for these charges |

| Cardmembers who promptly settle their minimum payment due for 12 consecutive months | 1.25% per month 15% per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the ou |

| Cardmembers who promptly settle their minimum payment due of at least 10 months or more in a 12-month cycle. The 12 months minimum payment due cycle will not apply to new cardmember. | 1.42% per month 17% per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the ou |

| Cardmembers who do not fall within the above categories | 1.50% per month 18% per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the ou |

| Minimum Annual Income | RM 24,000 |

| Minimum Age For Primary Card | 21 years old |

| Who Can Apply |

只需注册3分钟,您就可以访问所有已保存的车辆,购买历史记录并进行快速续约。