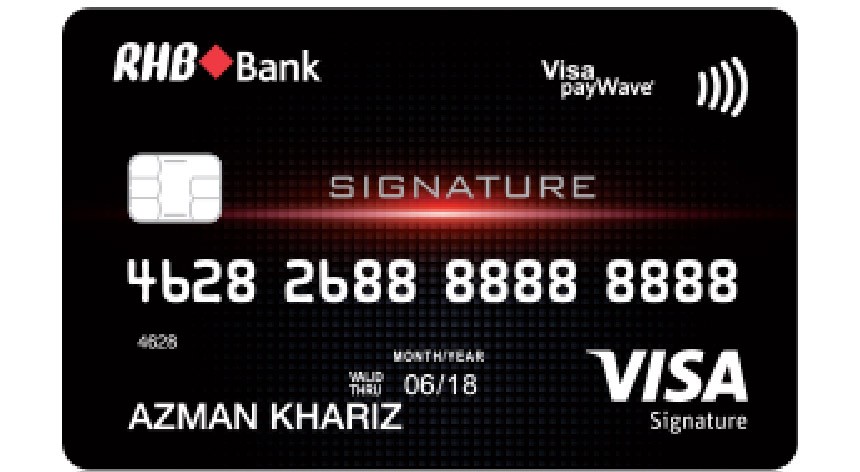

RHB VISA SIGNATURE CREDIT CARD gives you up to 6% Cash Back per month.

ApplyN/A

Free*

N/A

N/A

N/A

N/A

N/A

| Tier | Monthly Total Spend (RM) | DOMESTIC LOCAL SPEND | OVERSEAS SPEND | |||

|---|---|---|---|---|---|---|

| ONLINE | ENTERTAINMENT | SHOPPING | OTHERS | |||

| 1 | RM1,000 – RM2,499 | 1% | 1% | 1% | 0.20% | 0.50% |

| 2 | RM2,500 – RM3,499 | 2% | 2% | 2% | 0.20% | 1% |

| 3 | RM3,500 & above | 6% | 6% | 6% | 0.20% | 2% |

| Monthly Cash Back Capping | RM30 | RM30 | RM30 | Unlimited | RM100 | |

Cash Back excludes cash advance, charity, government and petrol transactions.

For the list of Merchant Category Code (MCC) which are eligible for Cash Back, please click here

| Online | Get your cash back on all online transaction. Example of online merchants: Lazada, Zalora, AliExpress, & other online merchants |

| Entertainment | Get your cash back on all entertainment nationwide under the Entertainment MCC. Examples: KL Bird Park, Petrosains, GSC Cinemas, Speedy, TGV Cinemas, & other entertainment outlets |

| Shopping | Get your cash back on shopping spend under the Shopping MCC. Examples: Zara, H & M, Charles & Keith, Pedro, & other retail outlets |

- 5x complimentary access in a calendar year to selected Plaza Premium Lounges / Aerotel in Malaysia, thereafter, a discount of 25% off the walk-in rates will be charged from the sixth visit onwards to lounges in Malaysia.

- Exclusive 25% discount at all Plaza Premium Lounges in Malaysia for all accompanying guest.

- Special 20% discount at Plaza Premium Lounges all around the world. (except Shanghai & Beijing)

Lounges’ facilities

Complimentary Food & beverages, High speed internet access, Entertainment & Flight Information, Newspapers & magazines, & Shower with amenities

Please refer to the Terms & Conditions for full details & the list of eligible Plaza Premium Lounges for respective RHB Credit Card.

Visit https://www.plazapremiumlounge.com/en-uk for the updated Plaza Premium Lounge locations around the world.

Enjoy complimentary tee off at the following golf courses:

For the full Terms and Conditions, please refer to RHB Premium Cards Golf Privileges 2022

| Golf Clubs | Booking Contact No. / Details |

|---|---|

| Sungai Long Golf & Country Club, Selangor, Malaysia | RHB Priority Line +603 9206 1111 |

| Palm Garden Golf Club, Selangor, Malaysia | |

| Glenmarie Golf & Country Club, Selangor, Malaysia | |

| Tropicana Golf & Country Resort, Selangor, Malaysia | |

| Kota Permai Golf & Country Club, Selangor, Malaysia |

|

-

|

Your purchase is covered from losses due to non-delivery or incomplete delivery of the goods. This benefit also covers you in case the goods you purchased online arrives with physical damage

|

|

-

|

Automatically activated when an item is purchased using an eligible Visa card.

|

|

-

|

Eligible for online purchases made from any merchants globally

|

|

-

|

Claims and insurance details can be made available online from AIG Cardholder Insurance Portal

|

|

-

|

| Annual Fee For Primary Card | waived |

| Annual Fee For Supplementary Card | waived |

| Minimum Monthly Payment | 50 |

| Late Payment Fee | Maximum of 1% of the outstanding balance or a minimum of RM10, whichever is higher, subject to a maximum of RM100.00 |

| Cash Withdrawal Fee | 5% of the transaction amount or a minimum of RM15.00, whichever is higher, will be charged on all cash withdrawals and licensed betting transactions. Any applicable taxes imposed from time to time are applicable for these charges |

| Interest Rate On Cash Withdrawals | 5% of the transaction amount or a minimum of RM15.00, whichever is higher, will be charged on all cash withdrawals and licensed betting transactions. |

| Cardmembers who promptly settle their minimum payment due for 12 consecutive months. | 1.25% per month 15% per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the out |

| Cardmembers who promptly settle their minimum payment due of at least 10 months or more in a 12-month cycle. The 12 months minimum payment due cycle will not apply to new cardmember | 1.42% per month 17%per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the out |

| Cardmembers who do not fall within the above categories | 1.50% per month 18% per annum To enjoy lower finance charges for the retail transactions, you should make at least 10 prompt payments in the last 12 months. Platinum Business: 15% p.a. of the outstanding amount calculated on a daily basis of the ou |

| On Cash Advance | 18% per annum will be levied on each cash advance calculated from the date of cash advance until it is fully settled. Platinum Business: 15% p.a. of the cash advance amount calculated on a daily basis. |

| Automatic Balance Conversion | An auto balance conversion for eligible Cardmember in every 12 months by converting the credit card outstanding balances (with a minimum amount of RM1,000) into a 3 years term loan, at an effective interest rate of 13% per annum. Cardmember has the flexib |

| Minimum Annual Income | RM 80,000 |

| Minimum Age For Primary Card | 21 years old |

| Who Can Apply |

Signing up only take you 3 minutes and you can have access to all your saved vehicles, purchase history and make fast renewal.